Online payment disputes and fraud

Online payment disputes and fraud

What is a dispute?

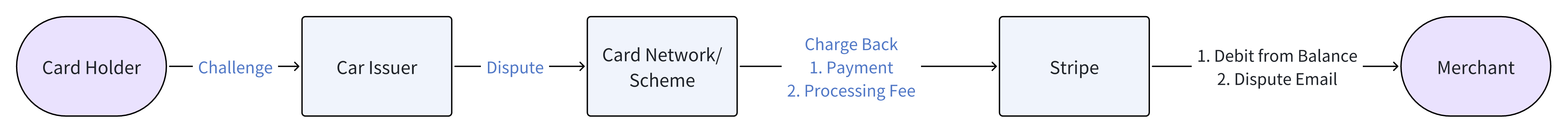

Dispute occurs:

when a cardholder raises questions or objections to a payment made using their card, often referred to as a chargeback.

The card issuer (the financial institution associated with the card) creates a formal dispute with the card network (VISA/Master/AMEX/EFTPOS).

The card network immediately withdraws the payment, pulling funds from Stripe, along with one or more dispute fees from the card network.

Stripe deducts the payment amount and dispute fees from your balance.

Dispute cycle:

After a dispute is initiated, you have 7-21 days to respond to the card issuer, and the card issuer also requires some time (usually 60-75 days) to evaluate evidence and make a decision. The entire dispute lifecycle typically lasts 2-3 months, and neither the merchant, Taptouch, nor Stripe can effectively expedite this timeline.

Dispute fees:

For each lost dispute, the merchant must pay $25.

If there are insufficient funds, the amount will be deducted from the merchant's account, with a fee of $3.5 per deduction.

Categories of disputes and prevention:

Disputes are typically raised with dispute codes, common reasons being fraud, unacceptable product, failure to recognize, etc. Refer to Stripe's dispute documentation for specific details.

Fraud:

This is the most common reason for disputes, occurring when cardholders claim they did not authorize a payment. Reasons for cardholders initiating fraud disputes typically include:

Friendly fraud: Cardholders may make a mistake and fail to recognize a legitimate charge on their credit card statement, or intentionally attempt to avoid payment.

Using stolen credit card information to make purchases.

These disputes are difficult to win because, in many cases, there is no issue with the dispute. Most outcomes result in the fraudster receiving the product, the account holder receiving a refund, and the merchant incurring losses, including product and money, as well as dispute fees.

Therefore, the most effective way to deal with fraud is prevention.

How to prevent:

As it's difficult to win fraud disputes, prevention is key. Good strategies include:

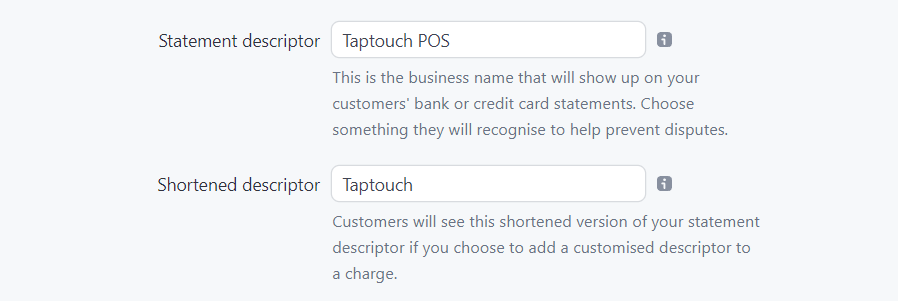

Correctly setting up your statement descriptor to ensure customers can easily identify the URL or business involved in their purchase. The statement descriptor will appear on the credit card statement of customers.

Sending receipts after payment so that customers remember what they paid for. Customers who consume on the Taptouch platform will automatically receive a link to the bill if they enter a phone number and email, making it easy to reconcile and download.

Radar feature: Taptouch enables Stripe's real-time fraud protection feature, Radar, for all online payment transactions. Radar evaluates the risk level of each payment based on hundreds of signals and data from millions of businesses worldwide. Payments with a risk level higher than "elevated risk" are automatically blocked. The Taptouch team also analyzes historical transaction records and continuously adjusts risk assessment rules to maximize customer payment experience while ensuring the effectiveness of the rules. These rules include but are not limited to:

Adding more blocking rules, such as traditional bank card CVC verification. If verification fails, the payment will be blocked, postal code verification, etc.

Requesting 3DS verification: For payments over $200, adding 3DS2 verification. If 3DS verification is successfully passed, any fraudulent dispute related to the payment is usually transferred from the merchant to the card issuer. In most cases, merchants do not need to bear the cost of fraud for payments that have been verified through 3DS. However, you may still receive early fraud warnings and may also receive dispute inquiries for payments that have been successfully verified through 3DS, but these typically do not result in chargebacks.

Responding to disputes

Notice of dispute

When the account holder disputes a payment, their bank notifies Stripe, which then notifies you through the following channels:

Email notification

Stripe Management Platform

Push notifications (if you have a subscription)

Each dispute notification channel provides a link to the dispute details page in your management platform, where you can learn more about the dispute reasons. The dispute notification will inform you of the deadline for the overall response.

Note

If no action is taken to resolve the dispute before the deadline, the payment amount will be refunded to the cardholder, irreversibly, and your account will be officially charged the dispute fee.

Understanding and making decisions on disputes:

Generally, Stripe's dispute details page provides a copy of the content submitted by the bank to Stripe, along with narrative descriptions of the complaints. When responding to disputes, make sure to address the issues described in the resolution document.

When deciding whether to accept or dispute a dispute, consider the following questions:

Is the account holder's request valid?

If not, do I have the necessary evidence to refute the above request?

If I want to resolve the customer's complaint amicably, for example, by providing an in-store refund or replacing the goods, can I persuade the account holder to withdraw the dispute?

Can the dispute be subject to the liability shift rule? If so, consider supplementing evidence based on the evidence automatically provided by Stripe, such as the result of 3DS verification.

Purpose and evidence of dispute challenges:

Note

You only have one chance to submit a response, and once submitted, all supporting documents will be immediately forwarded to the card issuer and cannot be modified or supplemented with additional documents, so make sure to collect all evidence before submitting. The submitted evidence is recommended as follows.

The evidence should explain and prove the following:

Legitimate cardholder or authorized representative (such as an employee or family member) indeed made the payment.

The payment has been successfully verified through 3DS and falls within the scope of liability transfer (Stripe will automatically provide you with Electronic Commerce Indicators (ECI)).

You have issued a refund to the cardholder.

The customer withdraws the dispute or confirms that they can recognize the charge, incorrectly raising the dispute.

For Visa, provide compelling evidence.

Restaurant service evidence

Proof that the cardholder is the diner or the person picking up the food (such as photos and emails)

Proof that the person who signed for the service is authorized to sign on behalf of the cardholder.

Proof that services have been provided to the cardholder, such as:

Takeaway receipt.

Address and phone number of the cardholder with whom contact has been established.

Proof that the dispute reason is invalid:

Signed order for products purchased by email or phone.

History of one or more undisputed payments on the same card.

Evidence of fraudulent disputes on the same card before authorization for this transaction.

Evidence of providing CVC when placing an order.

Submitting a dispute response:

You only have one chance to submit a response, so make sure you have collected all the evidence before submitting.

Open the dispute response form: Click "Dispute Response" to open Stripe's dispute response form.

Explain the dispute background:

Why do you believe the dispute is incorrect.

Product types of the original order.

Collect evidence. Uploaded files for submissions in the United States need to specify evidence categories, with only one file per category allowed. If multiple files point to one category of evidence, please merge them. The file size should not exceed 4.5MB.

Background evidence:

Delivery details.

Refund policy details.

Customer details.

Product details.

Submit evidence: Click the checkbox to confirm that you understand the response is final and submit evidence.

Viewing dispute status:

After submitting a dispute, you can see the refund status in your Stripe refund records.

After submitting the dispute, the dispute status changes to "Response Assessment."

When the card issuer notifies Stripe of its decision, Stripe will notify the result by email:

Won: The bank has made a decision in favor of the interests, and the bank will refund the amount withdrawn from the chargeback.

Lost: The bank made a decision in favor of the account holder's interests, and the refund becomes permanent, with dispute fees not refunded.