Disputes and Fraud in Online Payments

Disputes and Fraud in Online Payments

What is a dispute

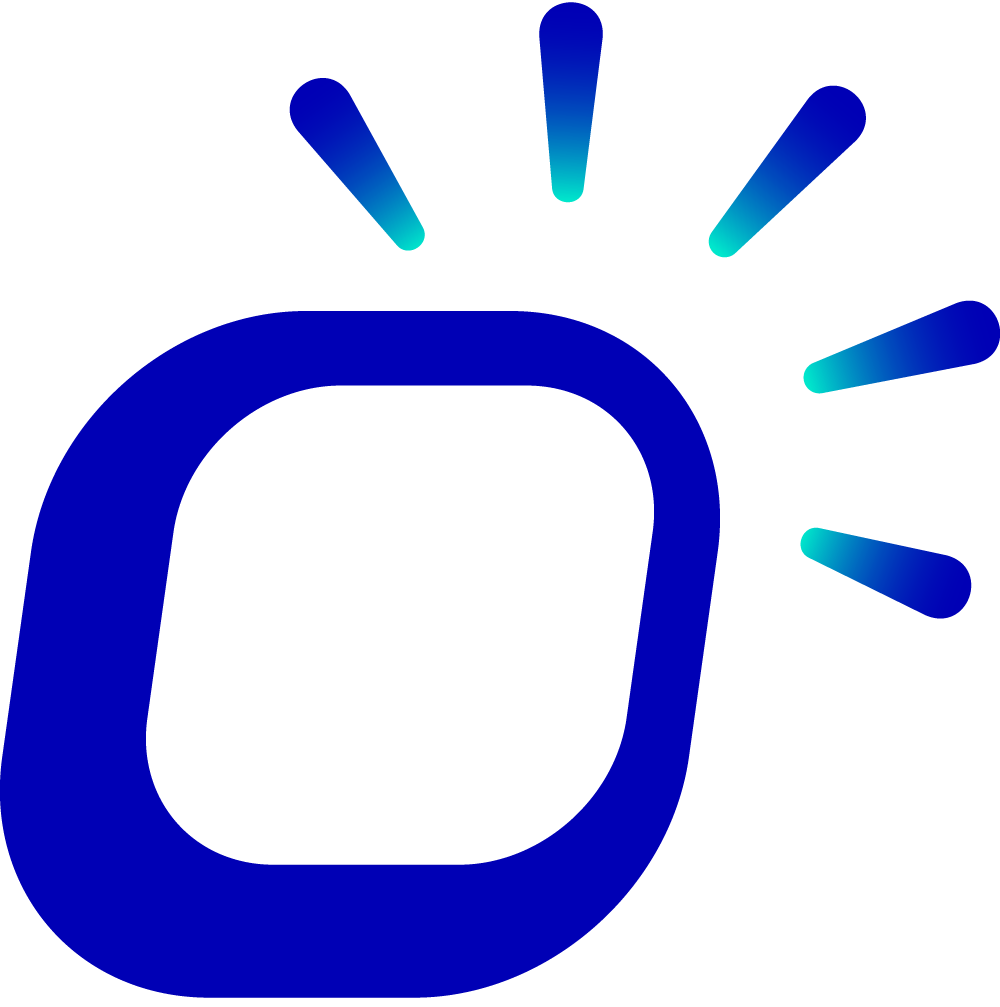

Generation of disputes

A dispute (sometimes a withdrawal) occurs when a cardholder challenges a payment to its issuer.

The issuing bank (the Financial Institution to which the card belongs) creates a formal dispute with the card VISA/Master/AMEX/EFTPOS.

The card organization immediately cancels the payment and pulls the payment funds from Stripe - as well as one or more card organization dispute fees.

Stripe deducts payment amounts and dispute fees from your balance.

Dispute cycle

After a general dispute is initiated, you have 7 to 21 days to respond to the issuer, and the issuer also needs a certain amount of time (usually 60 to 75 days) to evaluate the evidence and make a decision. The complete lifecycle of the entire dispute is generally 2 to 3 months, and merchants, Taptouch and Stripe cannot effectively accelerate this timeline.

Dispute costs

For each lost dispute, the merchant needs to pay 25 dollars.

If the balance is insufficient, you need to debit the merchant account and charge a fee of 3.5 dollars each time.

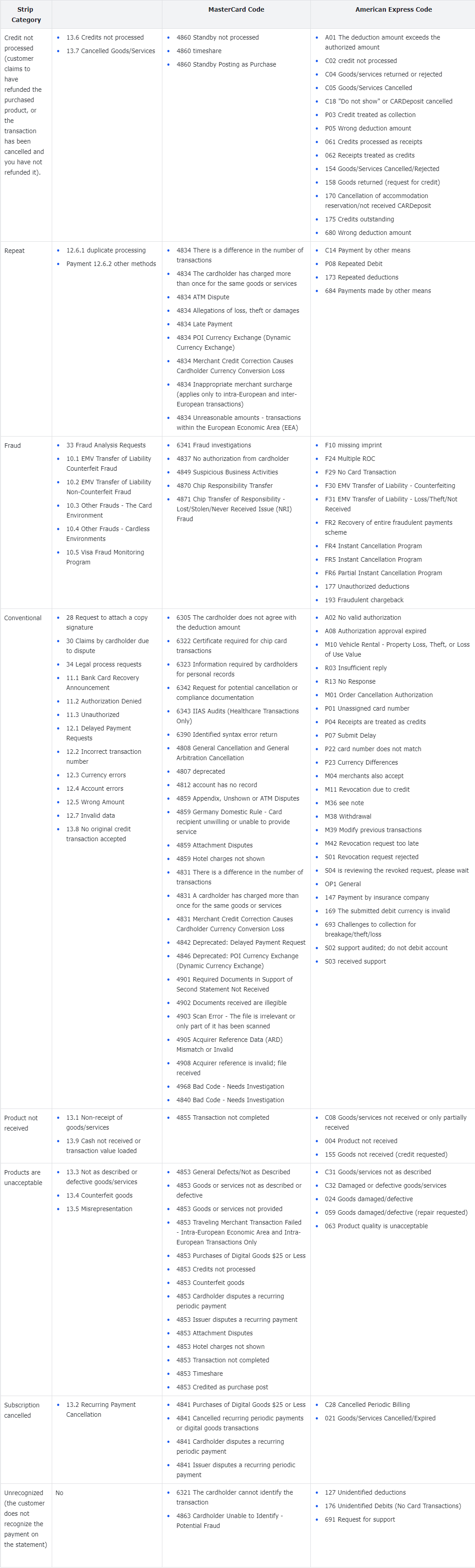

Categories of disputes and prevention

Generally, there will be disputed code when a dispute is raised. The common reasons are: fraud, unacceptable product, failure to identify, etc.

See Stripe's webpage for details: https://stripe.com/docs/disputes/categories

Of all disputes, fraud is the most common and the most difficult to deal with.

Fraud

This is the most common cause of dispute, which occurs when a cardholder claims that they have not authorized payment. The reasons for cardholders to initiate fraud disputes are generally as follows:

Friendly fraud: Cardholders may be mistaken, fail to recognize a legitimate receipt on their credit card statement, or intentionally attempt not to pay.

Stealing credit card information and paying for products and services.

This type of dispute is hard to win, because in many cases, the cause of the dispute is not in question. Most of the results are that the fraudster gets the product, the account owner gets a refund, and the merchant not only loses the product and money, but also pays the dispute fee.

So the most effective way to deal with fraud is prevention.

How to prevent

Since it's hard to win a fraudulent dispute, prevention is key. Good strategies include:

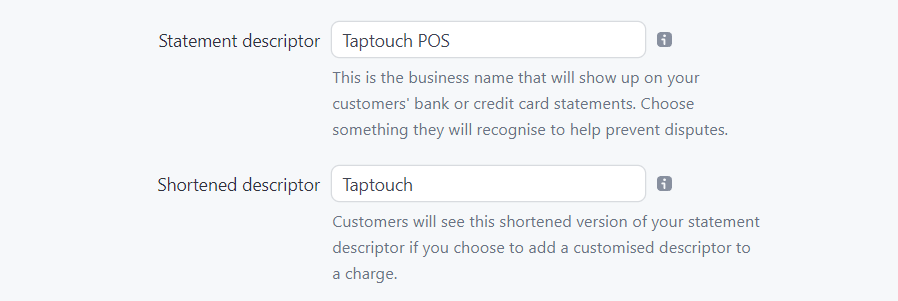

Set your statement descriptorcorrectly to ensure that customers can easily identify the URL or merchant involved in their purchase. The statement descriptor will appear on the credit card statement of the swiping customer.

A receipt is sent after payment so that customers can remember what they paid. For customers who consume on the Taptouch platform, if they enter their phone number and email, the system will automatically send a billing link for easy redemption and download and saving.

Radar function. Taptouch has enabled Stripe's Radar real-time fraud protection function for all online payment transactions. Radar will evaluate the risk level of each floating payment based on hundreds of signals from each payment and use data from millions of enterprise networks. Payments with a risk level higher than "elevated risk" are blocked by default. The Taptouch team will also analyze historical transaction records, continuously adjust threat and risk assessment rules, and maximize and optimize customers' payment experience on the premise of ensuring the effectiveness of the rules. These rules include but are not limited to:

Add more blocking rules, such as traditional bank card CVC audit, which will block payment if verification does not pass, zip code verification, etc.

Request 3DS Verification: For payments over $200 dollars, add 3DS2 verification. If 3DS verification is successful, any fraudulent disputes related to the payment will usually be transferred by the merchant to the card issuer. In most cases, merchants are not responsible for the cost of fraud for 3DS-verified payments. But you will still receive early fraud alerts and may also receive dispute inquiries for payments that are successfully verified by 3DS, but usually do not result in a withdrawal.

Dispute response

Notice of dispute

When an account owner disputes a payment, their bank alerts Stripe, which notifies you via:

Email notification

Stripe Management Platform

Push notifications (if you have a subscription)

Each Dispute Notification channel provides a link to the Dispute details page in your Management Shop where you can learn more about the cause of the dispute. The Dispute Notification tells you the final deadline for the overall response.

Note

If no action is taken to resolve the dispute by the deadline, the bank will refund the credit card amount to the cardholder irretrievably and your account will be officially charged the dispute fee.

Understand the dispute and make a decision

In general, Stripe's dispute details page will provide a copy of the content submitted by the bank to Stripe, with a documented description of the complaint text, and when responding to the dispute, ensure that the issues described in the document are resolved.

To decide whether to accept or challenge the dispute, consider the following questions:

Is the account owner's request valid?

If not, do I have the necessary evidence to refute the above claim?

If I want to resolve a customer complaint amicably, such as offering an in-store refund or replacement, can I convince the account owner to withdraw the dispute?

Can the transfer of responsibility rules apply to this dispute? If applicable, please consider supplementing the evidence provided automatically by Stripe, such as the results of 3DS verification .

The purpose and evidence of the dispute

Note

You only have one chance to submit a response. After the response is submitted, all supporting documents will be immediately forwarded to the issuer and you cannot modify the content of the response or submit additional documents, so make sure to collect all evidence before submitting.

The evidence submitted is as follows: https://stripe.com/docs/disputes/categories#dispute-category-types

Evidence should explain and prove the following:

The legitimate cardholder - or an authorized representative (such as an employee or family member) - did make the payment.

The payment has been successfully verified by 3DS and should fall within the scope of the transfer of responsibility (Stripe will automatically provide you with an e-commerce identity (ECI)).

You have issued a refund to the cardholder.

By withdrawing a dispute or confirming that it recognizes the receipt, the customer erroneously filed a dispute.

For Visa, provide convincing evidence .

Evidence of restaurant service

Prove that the cardholder is the diner or pick-up person (such as photos and mail).

The person who certifies the receipt of the service has the right to sign on behalf of the cardholder.

Demonstrate that services have been provided to the cardholder, such as:

Sign for takeout receipt.

Address and telephone number where contact has been established with the cardholder.

Prove that the reason for the dispute is invalid:

Signed orders for products purchased by mail or phone.

A history of one or more undisputed payments on the same card.

Evidence that the same card was fraudulently disputed prior to authorizing the transaction.

Evidence of CVC was provided when placing the order.

Submit a dispute response

Note

You only have one opportunity to submit a response, make sure the evidence is collected before submitting.

Open the dispute response form: Click Reject dispute to open Stripe's dispute response form.

Inform the background of the dispute:

Why do you think the dispute is wrong?

The product type of the original order.

Collect evidence. For documents uploaded by US, the category of evidence needs to be established. Only one file can be submitted for a type of evidence. If multiple files point to a type of evidence, please merge the files. The size of the asking price should not exceed 4.5MB.

Background evidence:

Delivery details.

Details of refund policy.

Customer details.

Product details.

Submit Evidence: Click the checkbox, confirm that you understand the response is final, and submit evidence.

View dispute status

After the dispute is submitted, you can see the refund status in your Stripe refund record.

After submitting a dispute, the dispute status changes to "Response Evaluation" status.

When the card issuer notifies Stripe of its decision, Stripe will email the result:

Won: The bank has made a decision in the interest of the issuer to refund the withdrawal amount deducted.

Lost: The bank makes a decision in the interest of the account owner, the refund becomes permanent, and the disputed fee is not refundable.

Appendix